The Lavazza Group announces that it has submitted an offer to acquire 100% of the share capital of the French coffee company MaxiCoffee. The Maxicoffee Group's business targets both private customers and commercial activities through its e-commerce platform, a network of 60 branches throughout France, its École du Café and its "Concept Stores". MaxiCoffee offers a variety of 8000 products including more than 350 different brands of coffee (beans, ground and capsules) and a wide range of espresso machines, coffee makers, coffee grinders and accessories. MaxiCoffee's capital is currently owned by its founder Christophe Brancato, 21 Invest and other minority shareholders.

After this acquisition, the Lavazza Group will become the majority shareholder and Christophe Brancato will reinvest in MaxiCoffee's capital with a stake of minority and will retain his role as President.

The transaction is subject to the prior information and consultation procedure of the Economic and Social Committee of the MaxiCoffee group companies and will subsequently be submitted to the General Directorate for Competition Policy, Consumer Affairs and Fraud Control (DGCCRF) for approval.

"The acquisition of MaxiCoffee will enable us to consolidate our positioning in France, which has always been a key market for the Group, and to strengthen our e-commerce footprint by increasing our presence in the B2C/consumer market. The operation fits perfectly into our international development strategy and, in particular, allows us to extend our already excellent and extensive sales and distribution partner network with a solid and leading company in its reference market, which shares the same values with Lavazza: product quality, a long-term vision and a strong focus on its employees and stakeholders," - said Antonio Baravalle, CEO of Lavazza - "Our strategy is to support the further development of MaxiCoffee, which will maintain its profile as a multibrand e-commerce platform and remain independent. Our entry will not change its successful business model in any way, on the contrary, it will foster its growth through the execution of our international development plans".

Christophe Brancato, President of MaxiCoffee, said. "Becoming part of the Lavazza Group and thus continuing the development of our business model represents an opportunity and an act of recognition for MaxiCoffee. The transaction will allow us to continue to satisfy and strengthen the already established relationships with our customers, consumers and suppliers. It opens up a new long-term phase of growth that will support us in achieving our development goals, in line with the social and human values that have always characterised the large MaxiCoffee community."

The MaxiCoffee Group was founded in 2007 in the south-west of France by Christophe Brancato, currently President of the company, with the aim of highlighting the versatility of the world of coffee on the one hand, and coffee as a vector of human and social development on the other. Today, MaxiCoffee employs around 1500 people, and in recent years has become a Phygital Platform of reference in the world of coffee. In addition, MaxiCoffee has more than 350 brands and 8000 products accessible to private customers as well as professional customers such as hotels, restaurants, offices and small shops. In addition to the e-commerce platform and its network of 60 sales outlets, it owns several concept stores located all over France and a series of Ėcole du Café based in Bordeaux, Marseille and Paris, certified training schools on coffee preparation and roasting techniques for coffee enthusiasts and future expert baristas and/or roasters.

François Barbier, Managing Partner & CEO of 21 Invest France, said: "We are ready to leave a company with which we have achieved an exceptional entrepreneurial growth path. Over the years, we have supported the transformation of MaxiCoffee from an SME to a leading national company specialising in the coffee sector, with a strong physical and digital presence, key levers for the Group's development. Today, the company is considered both for its know-how and its technological innovation, as a recognised phygital exponent of the coffee world. Lavazza and Christophe Brancato have chosen to continue this path of growth together, and we are convinced that Lavazza, with this investment, will continue to contribute to the long-term success of MaxiCoffee in France and abroad".

In the transaction, MaxiCoffee was advised by Mayer Brown, while Lavazza was assisted by BNP Paribas, Boston Consulting Group, PriceWaterhouseCooper, De Gaulle Fleurance & Associés.

With MaxiCoffee, the Lavazza Group will continue to enhance and increase its presence in all coffee segments in its target markets.

France highlights and news

An update about our last goals and projects.

Latest about 21 Invest

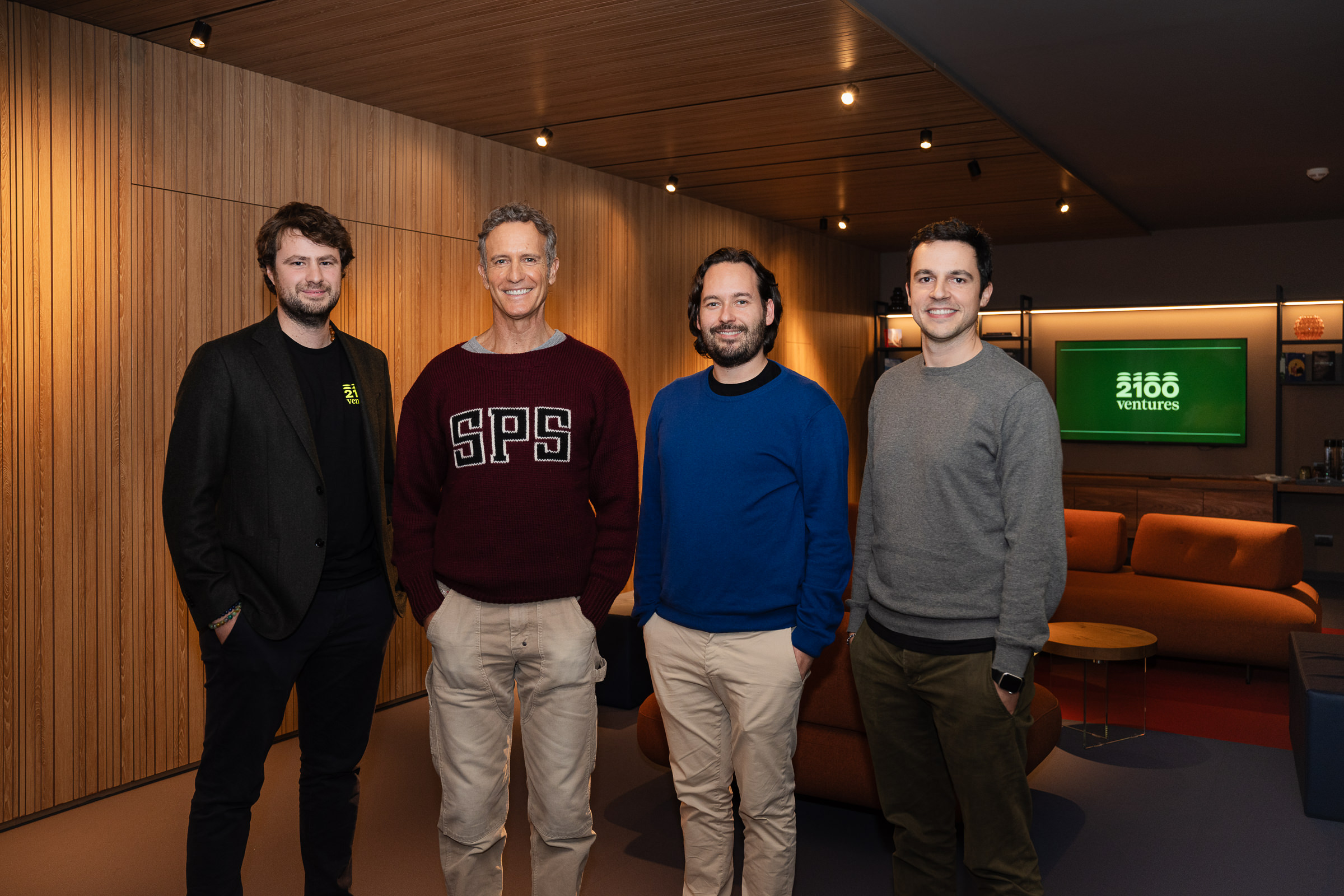

21 Invest expands into venture capital

1 February 2025

After more than 30 years of experience in the private equity sector, 21 Invest expands its investment scope into venture capital by investing in 2100 Ventures alongside Edizione, one of the leading industrial holding companies in Europe led by its Chairman Alessandro Benetton.